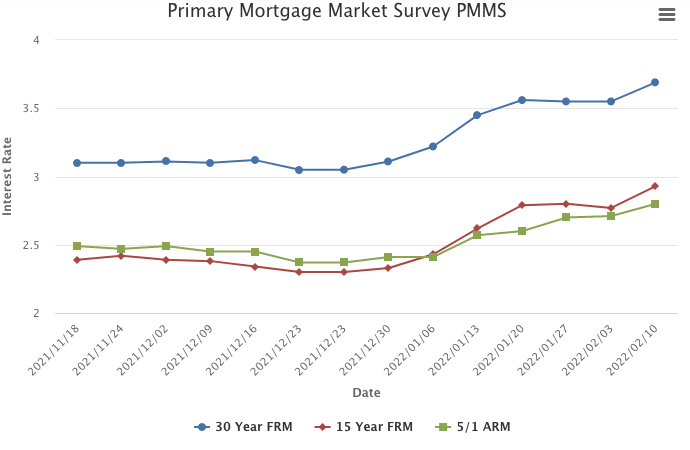

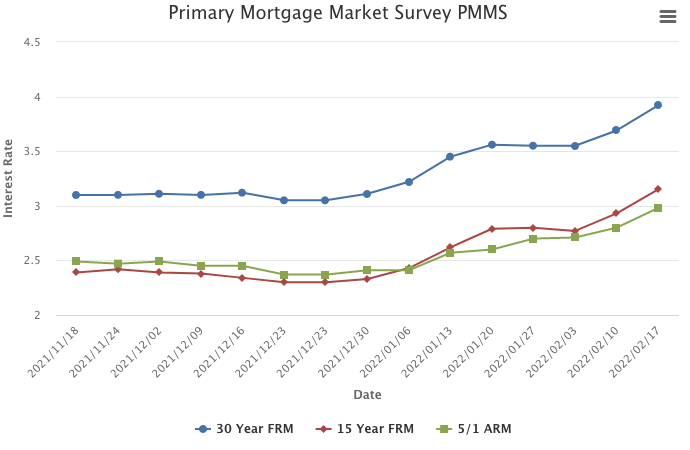

February 17, 2022

Mortgage rates jumped again due to high inflation and stronger than expected consumer spending. The 30-year fixed-rate mortgage is nearing four percent, reaching highs we have not seen since May 2019. As rates and house prices rise, affordability has become a substantial hurdle for potential homebuyers, especially as inflation threatens to place a strain on consumer budgets.

Information provided by Freddie Mac.