For Week Ending October 1, 2022

For Week Ending October 1, 2022

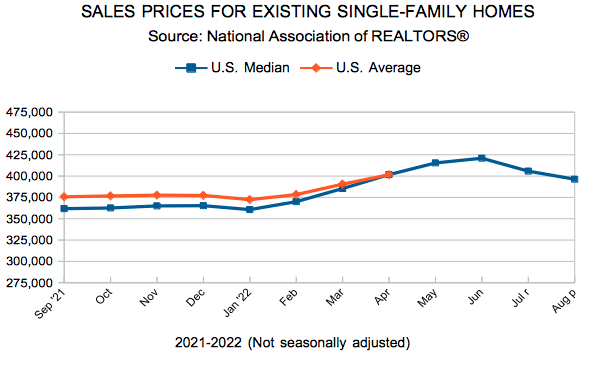

U.S. home prices are falling at the fastest rate since January 2009, according to recent data from Black Knight, as shifting market conditions have led many sellers to lower their asking price. Nationally, median home prices fell by 0.98% from July to August, marking the second consecutive month prices have declined. Although home prices are down 2% from their peak in June, they remain up 12.1 % compared to the same period last year.

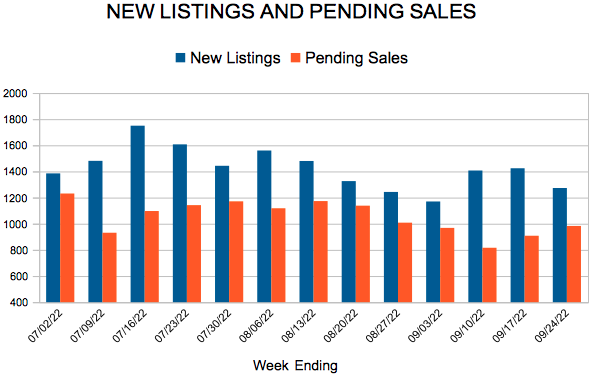

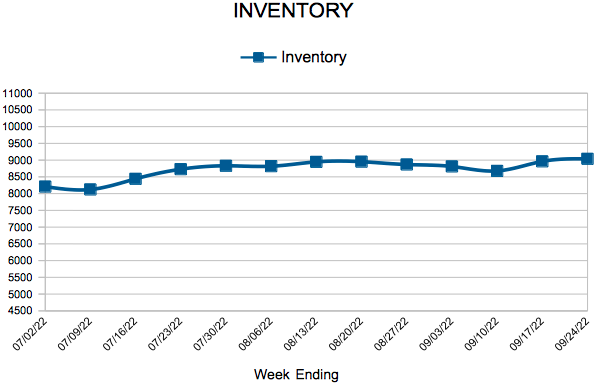

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 1:

- New Listings decreased 20.0% to 1,271

- Pending Sales decreased 36.5% to 895

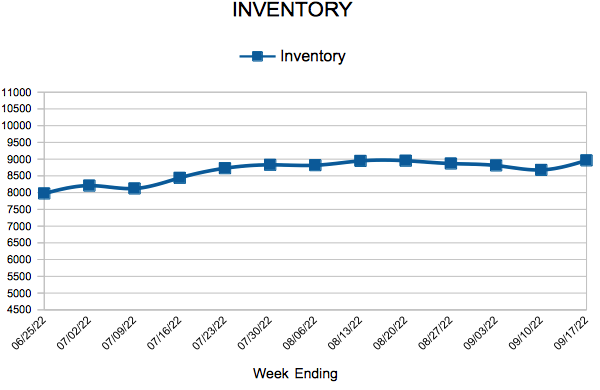

- Inventory decreased 0.8% to 8,934

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 5.7% to $369,900

- Days on Market increased 22.7% to 27

- Percent of Original List Price Received decreased 2.4% to 99.9%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.