Weekly Market Report

For Week Ending November 11, 2023

For Week Ending November 11, 2023

Despite sluggish home sales, US home prices have continued to increase, further impacting affordability for many prospective buyers. According to the latest S&P CoreLogic Case-Shiller Index, home prices were up 2.6% year-over-year and 0.4% month-over-month as of last measure, marking the seventh consecutive monthly increase. Additionally, the Federal Housing Finance Agency’s index found home prices increased 5.6% year-over-year and 0.6% month-over-month as of last measure.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 11:

- New Listings increased 12.0% to 981

- Pending Sales decreased 13.1% to 615

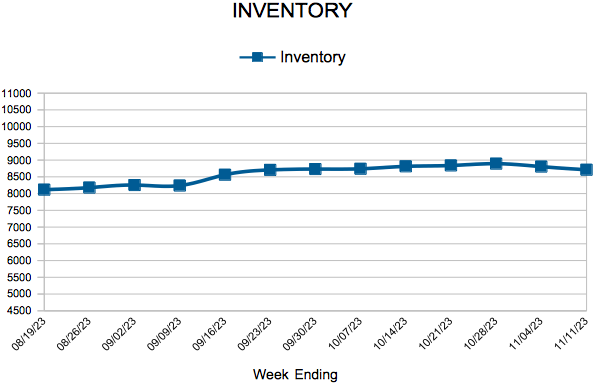

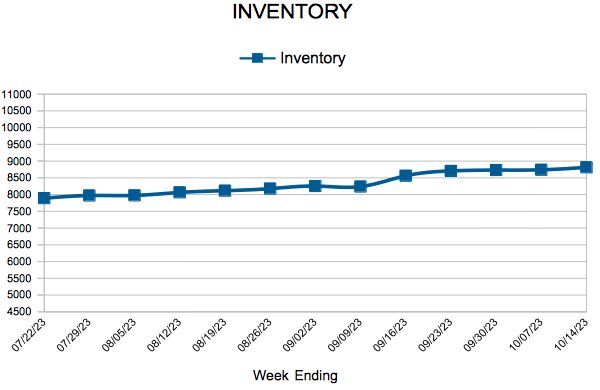

- Inventory decreased 5.3% to 8,711

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.4% to $365,000

- Days on Market increased 2.8% to 37

- Percent of Original List Price Received increased 0.2% to 98.4%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending November 4, 2023

For Week Ending November 4, 2023

Builder confidence continues to wane amid persistently high mortgage rates, which have remained above 7% since mid-August. According to the National Association of Home Builders, builder confidence in newly built single-family homes fell four points to 40 in October, marking the third consecutive monthly decline. Higher rates have priced many prospective buyers out of the market, while also driving up the cost of builder development and construction loans, further impacting supply and housing affordability.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 4:

- New Listings increased 6.6% to 1,048

- Pending Sales remained flat at 761

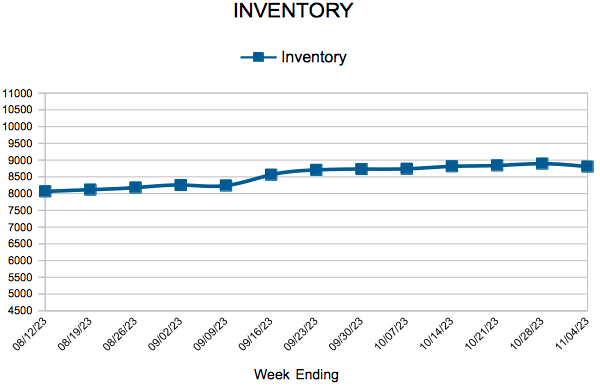

- Inventory decreased 5.8% to 8,805

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 28, 2023

For Week Ending October 28, 2023

Elevated mortgage rates have surpassed high home prices as the primary barrier to housing affordability, according to Fannie Mae’s latest Home Price Sentiment Index (HPSI), which fell by 2.4 points to 64.5 in September. The monthly decrease in HPSI was attributed to net decreases in 5 of the Index’s 6 components—Buying Conditions, Selling Conditions, Mortgage Rate Outlook, Job Loss Concern, and Change in Household Income—with the majority of consumers reporting that they expect mortgage rates will continue to rise over the next 12 months.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 28:

- New Listings decreased 9.1% to 986

- Pending Sales decreased 13.2% to 696

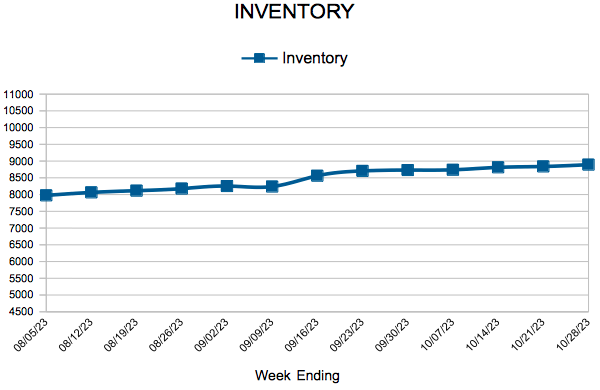

- Inventory decreased 6.3% to 8,893

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 21, 2023

For Week Ending October 21, 2023

Annual U.S. single-family rent growth fell to 2.9% in August, marking the 16th consecutive month of declines, according to Corelogic’s most recent Single-Family Rent Index (SFRI). Although rent growth continues to moderate, single-family rents have increased by 30% nationwide since February 2020 and renters are feeling the effects, with the average American renter household spending about 40% of its income on housing costs as of last measure.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 21:

- New Listings increased 3.2% to 1,160

- Pending Sales decreased 10.8% to 762

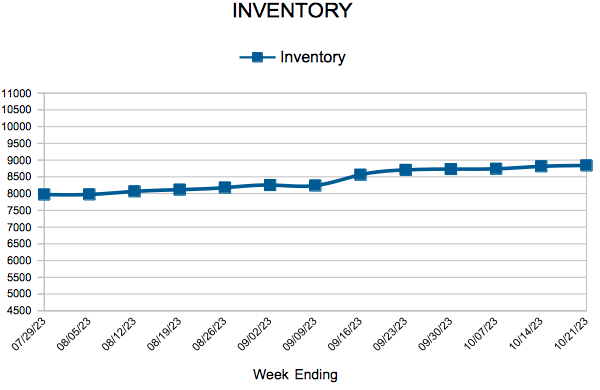

- Inventory decreased 7.5% to 8,839

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 14, 2023

For Week Ending October 14, 2023

According to ATTOM’s Q3 2023 U.S. Home Affordability Report, median priced single-family homes and condos were less affordable compared to historical averages in 99% of counties nationwide in the 3rd quarter of 2023. Home sale prices have continued to rise across the country, and with mortgage rates above 7%, major homeownership expenses now take up 35% of the average national wage, the highest level since 2007, and well above the 28% affordability standard commonly used by many lenders.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 14:

- New Listings decreased 8.8% to 1,187

- Pending Sales decreased 6.3% to 800

- Inventory decreased 7.8% to 8,813

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 18

- 19

- 20

- 21

- 22

- …

- 46

- Next Page »